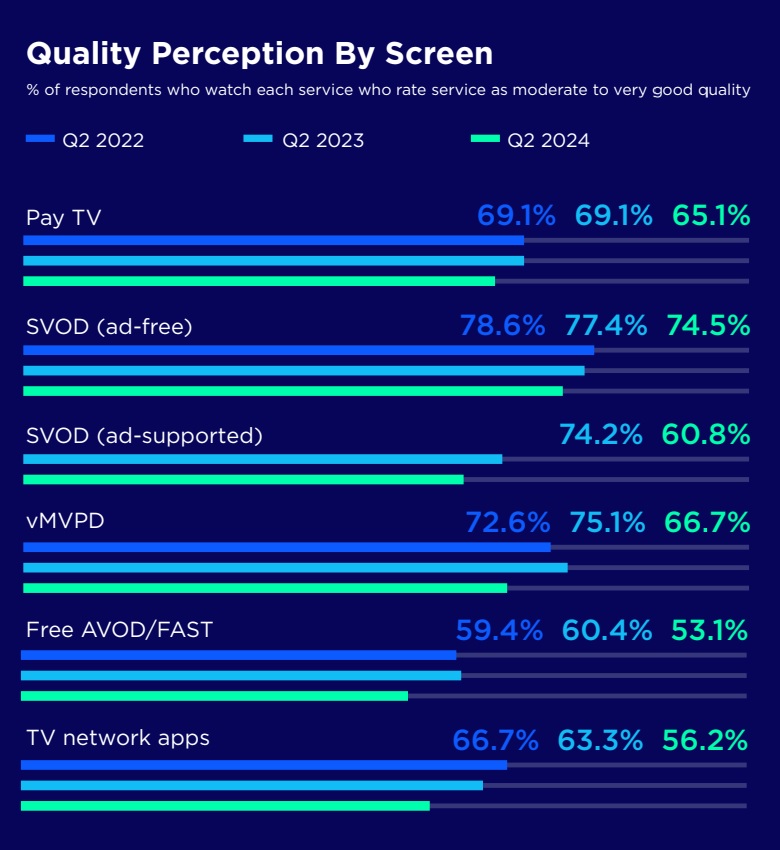

In Q2 2022, 78.6 percent thought their ad-free SVOD service had “moderate to very good” stuff to watch. But in Q2 2023, that dropped to 77.4 percent, and in Q2 2024, the percentage fell further to 74.5 percent. For ad-supported SVOD services, the percentage dropped from 74.2 percent in Q2 2023 to 60.8 percent in Q2 2024.

Ars Technica asked TiVo why subscribers may be feeling less satisfied with streaming content quality, and Scott Maddux, VP of global content strategy and business at TiVo parent company Xperi, pointed to some potential reasons while noting that other factors could also be contributors.

“As more and more consumers shift to ad-supported SVOD services, the perception of the content quality may have also shifted downward a bit,” Maddux said.

Maddux also suggested that streaming companies’ financial challenges could be impacting content quality:

The amount of new original content overall on SVODs may be down [year-over-year] as many streamers continue to struggle to hit profitability targets. Without new original content (or exclusive content deals), perceptions of value/differentiation may decline.

Similarly, a CableTV.com survey of 7,130 US streamers released in January 2024 pointed to a drop in subscriber satisfaction with streaming content quality. The publication asked respondents how satisfied they were with their streaming provider’s original content. Disney+, Hulu, Max, Netflix, and Paramount+ all saw their satisfaction rates fall from 2023 to 2024. However, Apple TV+, Amazon Prime Video, and Peacock all improved from 2023 to 2024.

In September 2023, Whip Media released its 2023 US Streaming Satisfaction report, which surveyed over 2,000 US streaming subscribers. The report said that the 2023 analysis:

clearly indicates that satisfaction among the top tier of streaming platforms is gradually declining while mid-tier platforms rise in overall satisfaction. The narrowing competitive market suggests there is high demand for showing the right mix of original and library content—and consistently maintaining a delightful viewer experience—in order to drive an overall value that subscribers expect.

Whip Media’s 2023 report found that Apple TV+, Hulu, Peacock, Paramount+, and Prime Video all showed gains in terms of the percentage of subscribers satisfied with the quality and variety of original content available on the platforms from 2022 to 2023.

+ There are no comments

Add yours