If you were hoping for a respite from rising streaming subscription fees in 2025, you’re out of luck. Several streaming providers have already increased monthly and/or annual subscription rates, continuing a disappointing trend from the past few years that doesn’t have a foreseeable end.

Years of pricing and value concerns

Subscribers have generally seen an uptick in how much money they spend to access streaming services. In June, Forbes reported that 44 percent of the 2,000 US streaming users it surveyed who “engage with content for at least an hour daily” said their streaming costs had increased over the prior year.

Deloitte’s 2024 Digital Media Trends report found that 48 percent of the 3,517 US consumers it surveyed said that they would cancel their favorite streaming video-on-demand service if the price went up by $5.

Similarly, in a blog post about 2025 streaming trends, consumer research firm GWI reported that 52 percent of US TV viewers believe streaming subscriptions are getting too expensive, “which is a 77 percent increase since 2020.” It added that globally, the top reason cited by customers who have canceled or are considering canceling a streaming service was cost (named by 39 percent of consumers), followed by price hikes (32 percent).

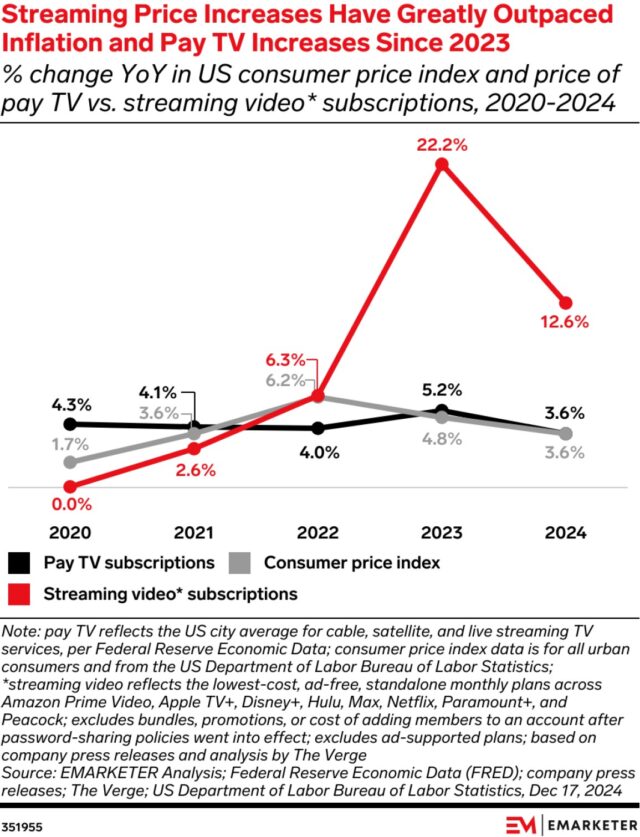

In its Digital Video Forecast and Trends Q1 2025 report, eMarketer (a marketing, ads, and commerce research firm that merged with Insider Intelligence in 2020) found that subscription fees for ad-free streaming tiers “have greatly outpaced inflation and pay TV increases since 2023,” as shown in the graph below:

“Pay TV packages and inflation have increased at similar rates in recent years. But over the past two years, streaming has gotten much more expensive relative to both,” eMarketer’s report says.

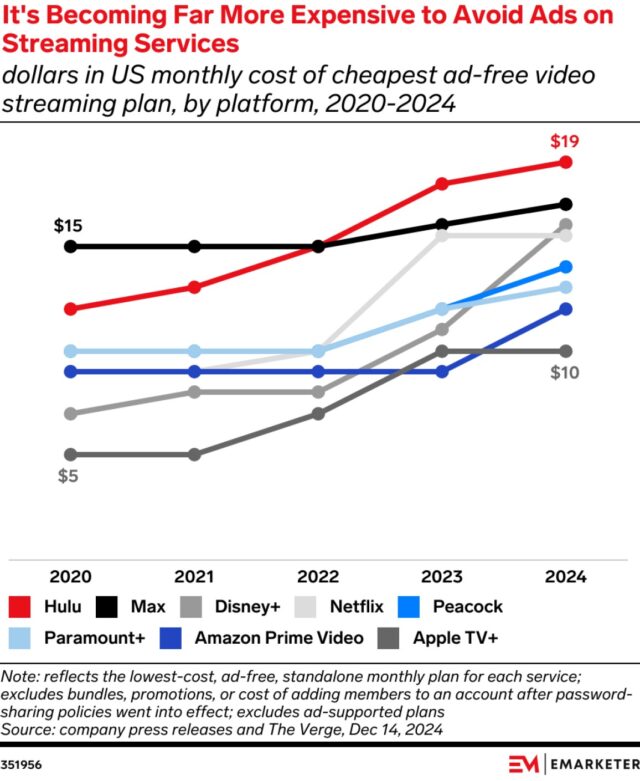

And people seeking ad-free streaming have had an increasingly expensive time since 2020, the research firm noted:

Meanwhile, some research points to subscribers perceiving the quality of content available on streaming services as subpar and/or declining. Thirty-six percent of respondents in Deloitte’s March report, for example, said that “the content available on streaming video services isn’t worth the price.” A Q2 2024 TiVo survey of 4,490 people in the US and Canada ages 18 and up found that fewer subscribers perceive their streaming services as having “moderate to very good” content. In Q2 2022, the percentage was 78.6 percent for ad-free subscribers, compared to 74.5 percent in Q2 2024. Ad-supported services also reportedly saw a drop here, going from 74.2 percent in Q2 2023 to 60.8 percent in Q2 2024.

+ There are no comments

Add yours