Google has killed off the Google Pay app. 9to5Google reports Google’s old payments app stopped working recently, following shutdown plans that were announced in February. Google is shutting down the Google Pay app in the US, while in-store NFC payments seem to still be branded “Google Pay.” Remember, this is Google’s dysfunctional payments division, so all that’s happening is Google Payment app No. 3 (Google Pay) is being shut down in favor of Google Payment app No. 4 (Google Wallet). The shutdown caps off the implosion of Google’s payments division after a lot of poor decisions and failed product launches.

Google’s NFC payment journey started in 2011 with Google Wallet (apps No. 1 and No. 4 are both called Google Wallet). In 2011, Google was a technology trailblazer and basically popularized the idea of paying for something with your phone in many regions (with the notable exception of Japan). Google shipped the first non-Japanese phones with the feature, fought carriers trying to stop phone payments from happening, and begged stores to get new, compatible terminals. Google’s entire project was blown away when Apple Pay launched in 2014, and Google’s response was its second payment app, Android Pay, in 2015. This copied much of Apple’s setup, like sending payment tokens instead of the actual credit card number. Google Pay was a rebrand of this setup and arrived in 2018.

The 2018 version of Google Pay was a continuation of the Android Pay codebase, which was a continuation of the Google Wallet codebase. Despite all the rebrands, Google’s payment apps were an evolution, and none of the previous apps were really “shut down”—they were in-place upgrades. Everything changed in 2021 when a new version of Google Pay was launched, which is when Google’s payment division started to go off the rails.

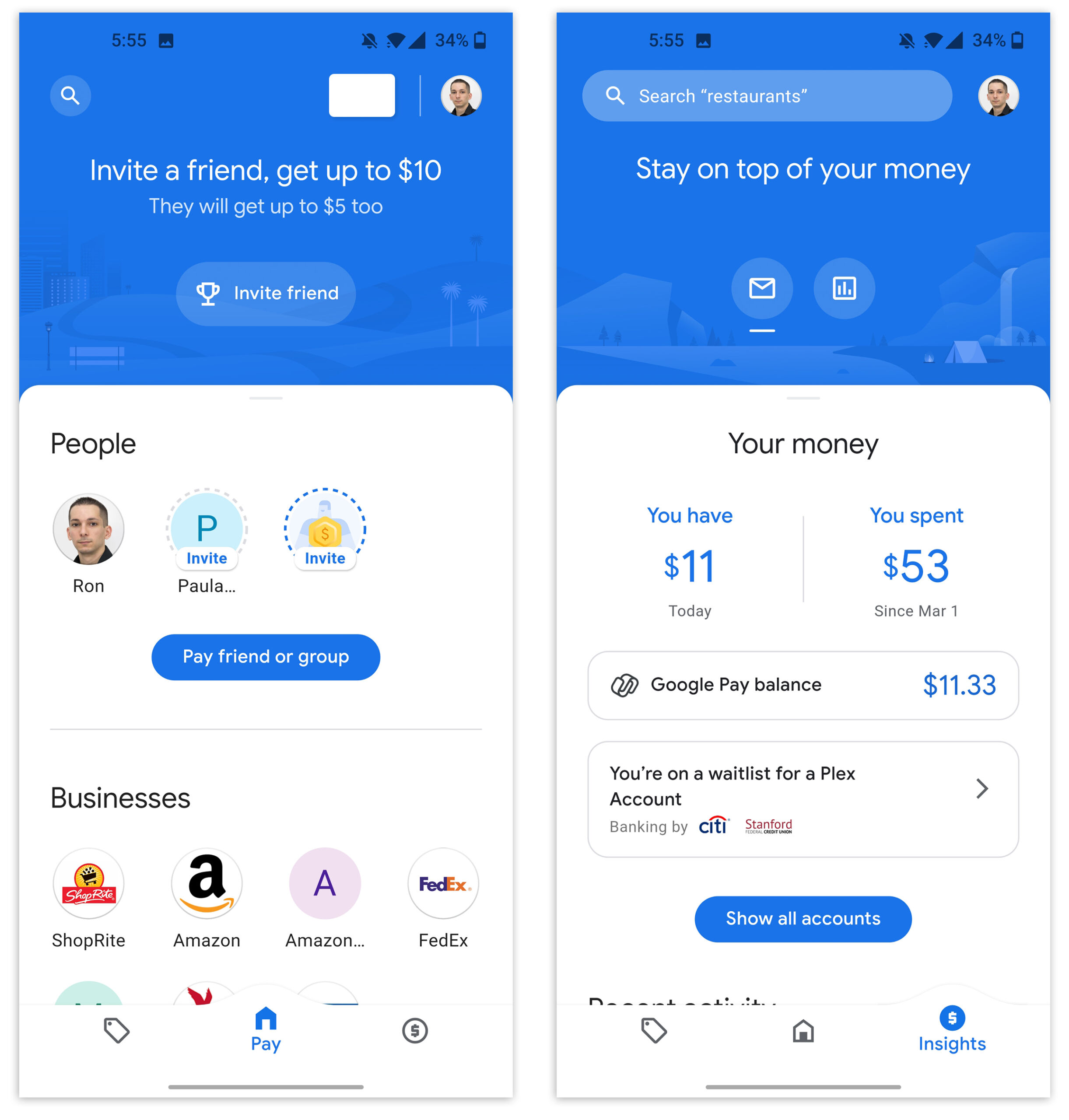

The now-dead Google Pay app.

Ron Aamdeo

The 2021 Google Pay was a totally different codebase based on a Google payments app that was originally developed for India, called Google Tez. Tez was rebranded to Google Pay for the US market and launched on the Play Store. Being designed for India, where a phone might be your first and only Internet device, meant the new Google Pay had a lot of design decisions that didn’t fit the US market. It used a phone number for your identity instead of your Google Account, and when you started it up for the first time, Google Pay didn’t know who you were. It was like signing up for a new service that wasn’t owned by Google. The phone number identity system meant Google had to shut down the previously useful Google Pay website, which could be used for peer-to-peer (P2P) payments, just like Venmo. You could only be signed in to one device at a time, which is maybe fine in the phone-exclusive world of India but weird in the US, where people have phones, watches, laptops, tablets, and PCs.

Because the two versions of Google Pay were separate codebases, Google didn’t upgrade users from the old app to the new app. They lived on the Play Store as separate apps, both called “Google Pay,” and for a while, it was possible to download and install both apps on your device. A big use case for the app was P2P payments, but money sent via the new app didn’t arrive on the old app, and vice versa, so for months of the transition, Google Pay just wasn’t a reliable money-sending service that normal people could figure out.

+ There are no comments

Add yours