Aurich Lawson | Getty Images

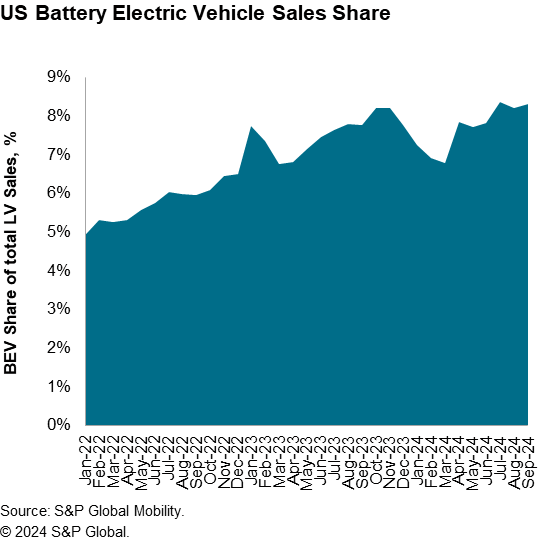

Battery-electric vehicles accounted for 8 percent of new vehicle sales in June and July of this year and should be above 8 percent for September, according to estimates from S&P Global Mobility. While growth has slowed from the heady 50 percent year on year we experienced in 2023, the trend is still positive, with market share increasing from 7 percent in the first three months of the year. That also has to be seen in the wider context of overall new vehicle sales, which are expected to drop by 12 percent this month.

“New vehicle sales remain stuck in neutral,” said Chris Hopson, principal analyst at S&P Global Mobility. “The overall tenor of the auto demand environment remains one of consistent, but unmotivated volume levels as consumers in the market continue to be pressured by high interest rates and slow-to-recede vehicle prices, which are translating to high monthly payments.”

The rapid growth of BEV sales in the US was, until recently, mostly a tale about Tesla. During the pandemic it flourished, as car buyers could order their Tesla online, and the automaker displayed far more flexibility over supply-chain hiccups than its legacy rivals. Sales soared, but not as much as the share price.

But ambitious goals for the end of internal combustion engine sales in Europe and the US started looking shakier last year. In 2024, that turned into full-blown EV pessimism from across the industry.

General Motors was one of the first to get cold feet. Technical problems slowed the launches of new BEVs from Cadillac, Chevrolet, and GMC, and in late January GM announced that it was shifting some resources away from BEVs and toward a new range of plug-in hybrids, despite having previously abandoned its innovative and efficient PHEV powertrain technology.

Similarly, Ford also started to back away from BEVs, despite nearly doubling sales. Last month the Blue Oval shuffled its product plans again, canceling some battery factories and a three-row electric SUV in favor of more hybrids.

And there has been big opposition from the very people expected to sell these new vehicles to consumers, with car dealers lobbying the White House successfully to soften impending fuel efficiency regulations.

Tesla has had the most torrid time of it, with a drop in sales that has seen its US BEV marketshare fall below 50 percent for the first time. An aging product lineup and the behavior of CEO Elon Musk have done much to erode Tesla’s brand, particularly in the nation’s largest market for electric vehicles.

US EV sales from 2022–2024.

S&P Global Mobility

But even with Tesla’s sales slump and some general month-to-month volatility, there are enough new BEVs arriving in showrooms, including the competitively priced Chevrolet Equinox and the long-awaited Volkswagen ID. Buzz, that S&P Global Mobility says that BEV sales are expected to grow throughout the rest of 2024.

+ There are no comments

Add yours